Navigating the Crypto Market: How SnatchProfits Trading Bots Adapted to the Bear Market

Bitcoin has bounced back to $24,000, potentially signaling the end of the bear market.

It's been a challenging year in the crypto market, with a bear market hitting hard due to geopolitical tensions and the ongoing rate hikes by the Federal Reserve. Bitcoin, which had hit a high of $64,000, tumbled down to $16,000. Despite these challenges, we've been hard at work improving our trading bots and updating our AI models.

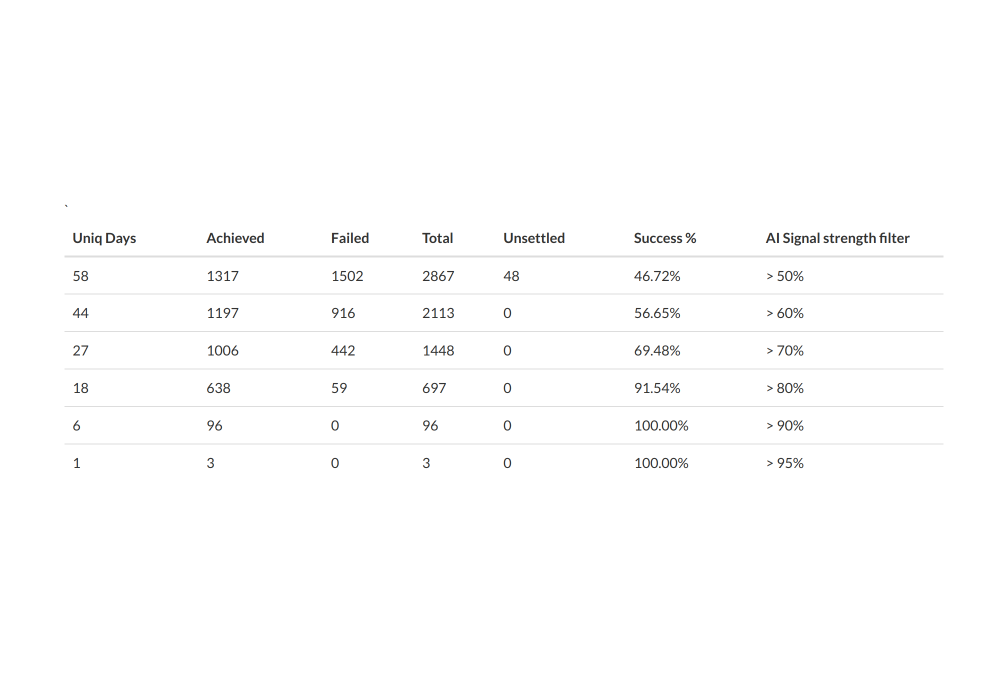

One major update we made to our AI models was to improve the training method to reduce overfitting with the data. This ensures that our bots can make better predictions that are less reliant on historical data. Additionally, we've added a new feature that provides weekly and monthly trend follow-ups to help protect against trading against the general trend, which can be difficult for our AI to detect if something huge is happening in the world.

During the bear market, our equity results dropped significantly. The Scalp bot, which had previously reached 100% equity gains, dropped to 50%, and the Swing bot went from 40% gains to 20%. However, we're pleased to report that the market has started to recover, with bitcoin now trading at around $24,000. Our updated trading systems are once again making gains.

In fact, we're seeing very promising results from our updated AI models over the last three months. So much so, that we've created a third trading algorithm that has just started trading. This algorithm has been designed to take advantage of leverage trading, which we expect will help us surpass the equity results of our previous bots quite quickly.

It's been a challenging year, but we're excited to see our updated AI models and trend-following algorithms perform well even in the midst of market turbulence. As always, we don't sell our trading services to clients, but we're thrilled to offer subscribers an inside look at our AI predictions and the live trades of our Scalp and Swing bots. Stay tuned for more updates on our progress and new trading algorithms.

Posted 2 years ago by Darius

Add a comment