Scalp & Swing bots BTCUSD trading systems explanation

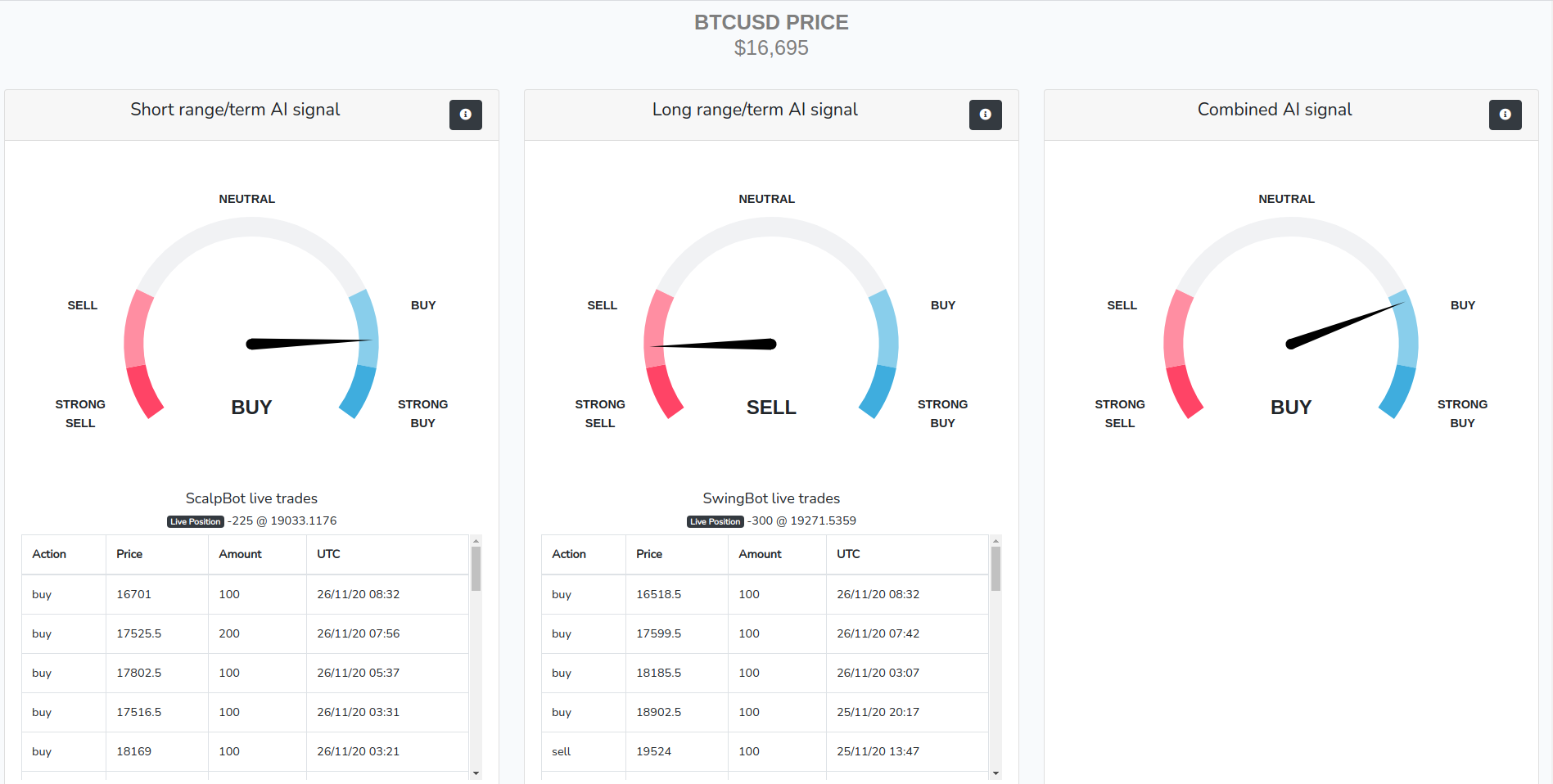

It’s time to cover how my automated trading systems work. What are their strengths and what are their weaknesses. I call one of the systems the “Swing” system, it trades the way I’d trade myself, with a conservative approach. Another system is called “Scalp”, this is a way more aggressive and way more active system.

Bots use AI signals as brains. Same as you would do technical/fundamental market analysis and you would use your analysis with trading strategies you have. AI is analysis, bots are the strategy. As we all know, bad trading strategies can kill any good market analysis. Compared to the human brain, AI can take and re-evaluate market conditions every 5 minutes 24/7. Remember market conditions change every day, and bearish trends can quickly change, with increased buying pressure and with new trends forming, while some over-leveraged positions get squeezed and killed along the way. Humans usually stick to their previous analysis, as long as they can, AI doesn’t.

AI sends those new analyzed conditions as probabilities arrays. Bots receive three numbers which in sum will always be 100%. AI provides it’s mathematically based opinion (probability) with the percentage that the market will go down from the latest price, with the percentage that the market can stay sideways, with the percentage that the market will go up. Bots take those scores and make decisions based on the scores plus on what recent actions were taken, what size, and what direction positions currently open.

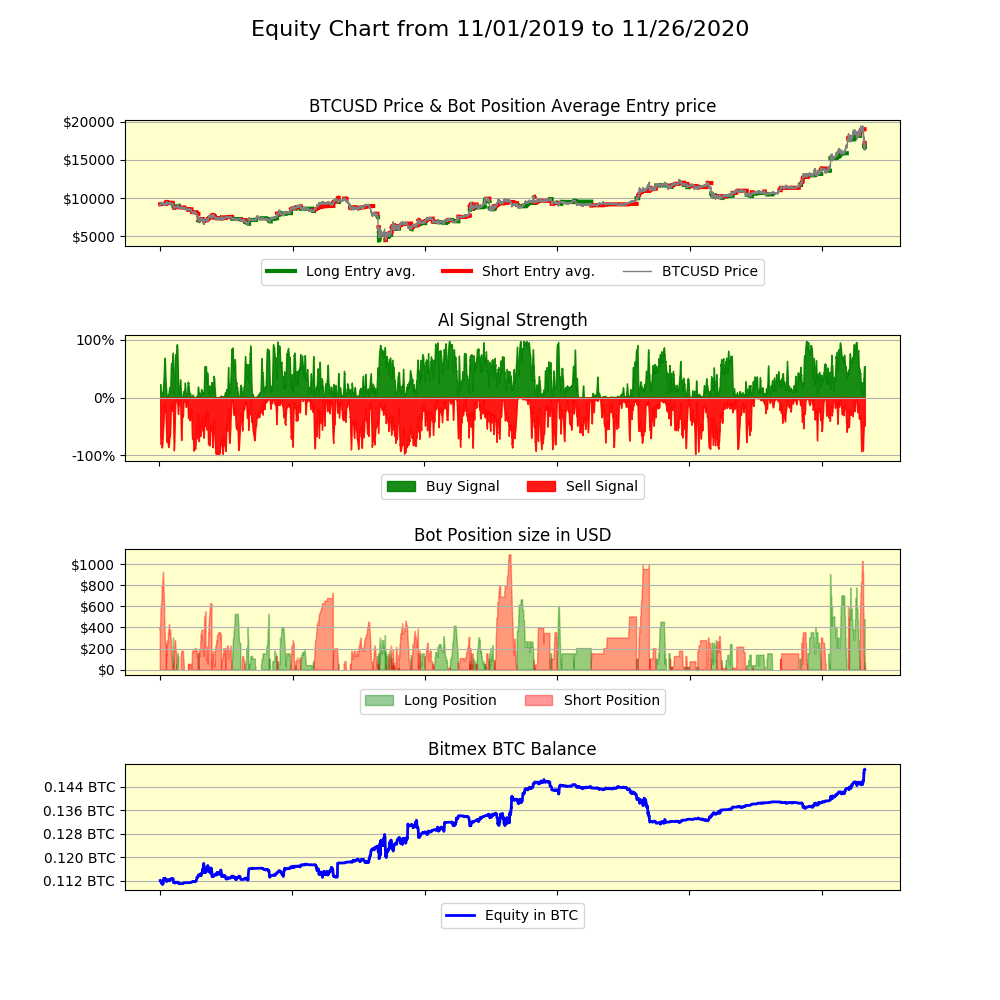

Scalp bot uses short-range AI scores, Swing bot uses a combination of short & long range AI scores, as an average to find best places to increase/decrease positions, placing many small bets along the way. No one in the world can know exactly what will happen next, that’s why bots use AI scores to help make decisions but not to trade blindly on them. Even though I think that my strategies are quite good, they're definitely not perfect. I’ve been interested in trading since 2013, and have been trading actively myself with different approaches for the last 3 years. So those strategies are as good as my short experience.

There are two main differences between Scalp & Swing bot systems. One has internal clock resetting every 4 hours and starts building position with DCA Y of every 0.25% of price movement from last trade when Swing bot system has internal clock set to 8 hours and DCA Y starts from 0.75%. DCA Y increases with growing open position. Larger position bots have, larger DCA Y requirements become. Those can grow up to 3% and more. Meaning that there would be no action taken unless the price moved more than 3% from the last trade or entry price.

So what is DCA X & DCA Y?

DCA X is dollar-cost averaging through time. So this is where the internal clock comes. When the internal clock resets. bots ignore the last trade price and go back to position average entry. DCA Y is dollar-cost average through price. So if AI says it is time to long, and DCA Y right now is at 1% cap, and the price is lower than that from initial entry price or last trade depending on an internal clock, we have both rules satisfied, we increase our position by placing a small limit order. When the limit order gets filled, the internal clock starts going again, the bot will use that last limit order price until the internal clock resets again. DCA X & DCA Y is used not only to build positions but also to take profits and descale positions as well.

Another major rule that bots follow is the average price traded through a specific time. We don’t want to be short below the average, or long above the average, no matter what AI tells us, just to be safe and conservative. For scalp bot, I use 36 hours average price, Swing bot uses much longer, one-week average traded price. Both averages roll through time.

There are also position limits, larger positions we have running at the moment, stronger AI signals required to increase positions even further.

Descaling

Bots also are capable of descaling positions in two ways. One if we short BTC at 17k with a strong sell signal, and the price drops instantly, we only check what was the last trade and if it is positive, we instantly take the profits, even though the average price could be running in the negative.

Another strategy used to solve this problem is what to do if we get stuck with a short position and the market starts running and even AI changes its opinion to bullish from now on. Bots don’t rush to do anything crazy, you can create large losses by chasing market spikes. Bots wait and bot close positions on their own terms. Bots wait for the price to return to its traded price average for a chosen time period and if AI is still bullish, we start closing those positions in negative slowly over time, not rushing anything, Having in mind that price could continue to drop or AI could provide new bearish analysis on the market. Market conditions change all the time, so does AI opinion.

Risk & Reward

For risk & reward. Scalp bot takes at least 1.5% profits, Swing system takes at least 3.0% profits. So if we do DCA Y every 0.5%, and take profits at 1.5% R:R ends up being 3.

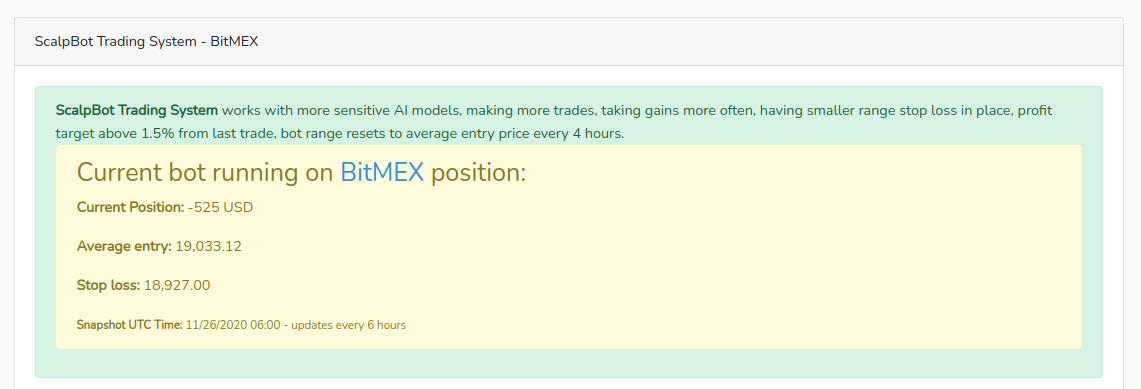

Stop Losses

But we also have to have hard stop losses, anything is possible in these markets. Stop losses are calculated dynamically, depending on how volatile the market is right now. But there are hard limits here as well, Scalp bot can't set a stop position more than 12% from its average entry price, and the hard limit on Swing bot system is 30% from its entry price.

Strengths & Weaknesses

Of course, these systems are not perfect, both scalp & swing bots have their strengths and weaknesses. Scalp bot can make many small trades, and pick up running wild trends and just hit it together with the market. But when the market suddenly changes the trend, Scalp bot can get stuck, and stop-loss can get hit quite easily, losing most of the profits made over past days. The goal is to end up with some profits, but there will always be ups and downs and Scalp bot will keep hitting those stop losses once in a while.

Swing bot on other hand is not chasing every trend, it follows much longer / older trends. So it builds positions over weeks and months until those end up positive. But a big weakness is that stop loss is quite wide and if you end up with a huge losing position in a sudden bull/bear market you might not find good points to descale positions and jump into a new big trend you end up missing all the run together with losses instead of profits, even though AI changed its opinion to correct direction long time ago.

Where to follow bots in action?

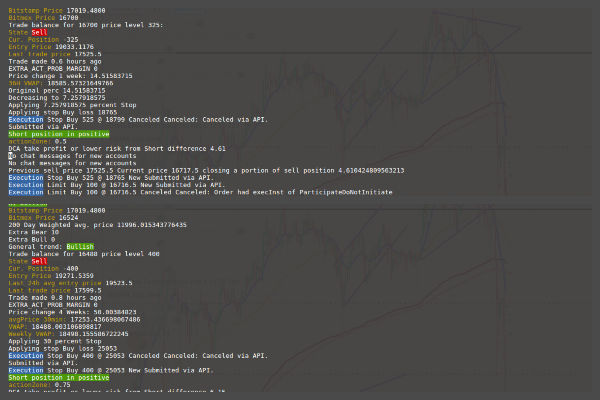

You can always see what my bots are doing in the Scalp bot / Swing bot section, with current positions / stops & equity charts provided, keep in mind this is not live. It is lagging by not much, 6 hours of real bots action. Live scores are here.

Posted 5 years ago by Darius

Add a comment